Bildnachweis: Wararat – stock.adobe.com, R. Gygax and T. Meier.

We previously discussed the principal forms of participating and non-participating liquidation preferences typically applied in investment agreements and argued that the participating scheme provides a balanced and fair distribution between founders and investors at low exit valuations. Many technology companies require multiple financing rounds. Such more complex payout schemes are discussed here.

Liquidation preference (LiqPref) clauses are standard elements in investment agreements. We have recently discussed, the impact of the two standard forms, the participating versus the non-participating liquidation preferences, on distributions to founders and investors, in particular at low exit valuations.

The impact of Liquidation Preferences in multiple sequential investment rounds

Multiple rounds of venture capital financing result in the issuance of multiple preferred share classes, whereby the last invested money enjoys the highest-ranking protection. Table 1 provides a representative example of a case with three preferred share classes originating from three different investment rounds (Seed round, Series A and B rounds). How does the choice of the liquidation preference scheme influence the payout in such a multi-round investment scenario?

Table 1: Example to illustrate the staggered share classes from multiple investment rounds as basis for a pay-out at exit.

What are the payout dynamics in accordance to the LiqPref applied?

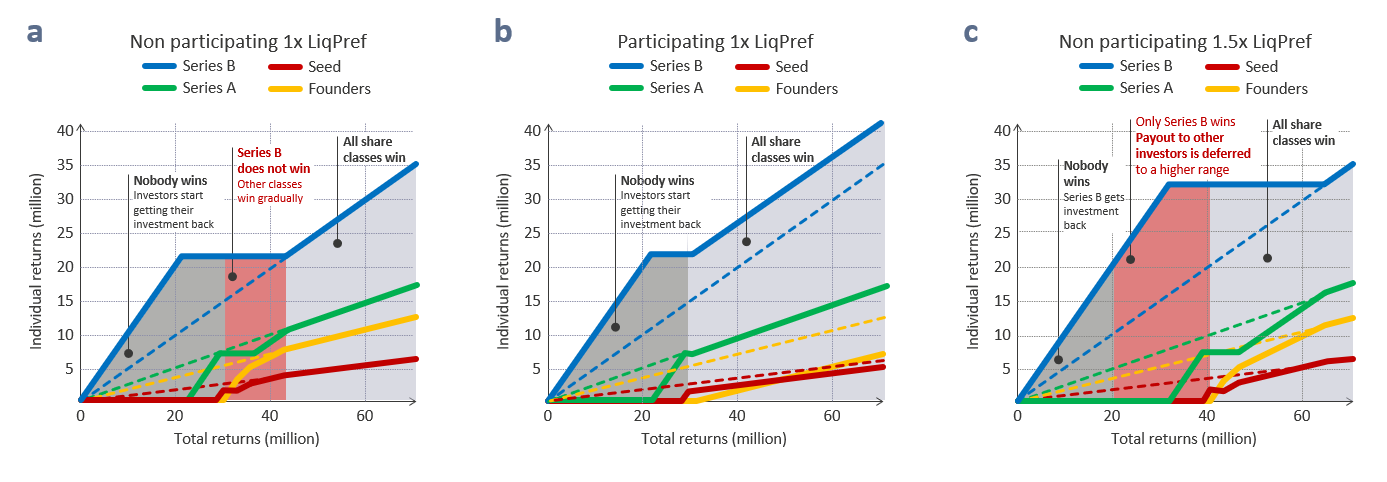

In the following, we assume that the LiqPref method applied is the same for all sequential financing rounds. Figure 1 illustrates the dynamics in the distribution of value for the non-participating (Fig 1a) or participating LiqPref (Fig 1b) in relation to an anticipated payout amount. As illustrated, the staggered share classes defined in Table 1 benefit differently, depending which LiqPref is applied. Fig 1c illustrates a case that protects a multiple of the amount invested in Series B.

For analysis, we consider sequential phases of the payout as follows:

First Phase for distribution of the protected amount

(in Fig. 1a and b: payout amount between 0 to 29.5 million)

Initially, assuming sufficient funds are available for distribution, investors will receive the amounts they had invested, the so-called ‘protected amounts’. Protected amounts are paid to the different share classes in reverse order of investment (last-in-first out). As shown in Fig. 1a and 1b, pay-outs are identical for both types of LiqPref in this first phase. It is reasonable to consider the repayment of the investment amount not as a ‘win’ for the investors and consequently no party wins in this first pay-out phase.

Second phase for non-participating LiqPref

(in the example: payout amount 29.5 to 42.75 million)

As shown in Fig. 1a, further distributions for preferred shareholders are put on hold up to the point at which each share class would receive more than their protected amount if treated as common shareholders. Going to increasingly higher exit values, the Seed investors are the first class, for which it becomes more lucrative to be treated as common shareholders. We perform a calculation, assuming only Series A and B shareholders receive their protected amount (in total 28 million) while the surplus amount is distributed pro rata to common and Seed shareholders and compare the outcome for the Seed investors with what they receive by their formerly protected amount. It turns out that at an exit value of 32.5 million the resulting payment is the same for both calculations and above such value the Seed investors are better off if treated as common shareholders.

Similarly, Series A investors are being treated as common shareholders above 35.5 million, and Series B investors above 42.75 million.

Third phase for non-participating LiqPref

(in the example: payout amount above 42.75 million)

Thus, at values higher than 42.75 million, all shareholders are treated as common. Remarkably, this point corresponds to the post-money valuation of the Series B round or generally of the last investment round. Distributions above the last post-money value are strictly the same as if no LiqPref was in place; i.e., all proceeds are distributed purely pro rata of the shareholdings, and the LiqPref is obsolete.

Interpretation regarding non-participating LiqPref

With an exit at or around the last post-money value, Series B investors only receive roughly their investment back and are not rewarded at all for the risk they have taken. In contrast, founders as common shareholders receive significant amounts in cash for their formerly illiquid assets, even though at an exit equivalent to the post-money value no value has been created since the last financing round. Therefore, non-participating LiqPref is unattractive from the Series B investor point of view at low exit valuations.

Like founders with common shares, also earlier investors (Series A and Seed investors), profit from some upside at any payout which exceeds the protected investment amounts. Specifically, with an exit at the last pre-money valuation, they realize the upside (if any) that was reflected in the pre-money valuation of the Series B round as compared to the valuation valid at the time they had invested. In contrast, the Series B investors realize no gain in the “red zone” of Fig 1a, which marks their disadvantage under a non-participating LiqPref.

Second phase for participating LiqPref

(in the example: payout amount above 29.5. million)

For participating LiqPref, paid-out protected amounts remain and have no effect on distributions of the surplus which are pro rata to all share classes. The reason why we advocate in favor of the participating LiqPref scheme is that all shareholders (founders and investors alike) start realizing gains at the same point. There is no red zone in Fig 1b.

Protecting Multiples of the invested amounts

Above, we have identified an exit range close to the last post-money value as the “red zone” for Series B investors if the non-participating LiqPref payout scheme is applied. Are there other ways than participating LiqPref to avoid such a shortcoming and dis-incentive for late investors? One concept that is sometimes considered is to have more than the invested amount protected, be it that the protected sum is increased over time by an interest rate or that a multiple of the investment is protected up-front. Fig 1c shows the example case with a 1.5-fold protection for the Series B investors. However, this approach grants an “unfair advantage”, this time for the late investor who enters the profit zone before the founders and early investors.

Conclusion

Our discussion shows that among several LiqPref schemes, the participating LiqPref turns out to be the most balanced and fair pay-out method at an exit after multiple investment rounds. All parties, founders and investors, simultaneously start generating cash gains at the same exit valuation.