Bildnachweis: blankstock – stock.adobe.com.

Investment in the life sciences sector is facing challenges, with fewer deals and increasing market uncertainty. Despite these difficulties, however, investment volumes are on the rise, suggesting a strategic shift rather than a full downturn. Is this the decline of venture capital in European biotech, or a necessary evolution towards more targeted and discerning funding? By Selina Greuel, Philipp Steinbach and Merlin Greuel

The life sciences ecosystem is currently facing significant challenges, with escalating costs, regulatory hurdles, and market volatility contributing to a more cautious funding climate. Although global mergers and acquisitions (M&A) deal values have remained relatively steady across various sectors, the life sciences sector saw a decline in M&A activity in 2024 compared to the previous year, despite coming off a strong 20231. The number of M&A deals in life sciences dropped by just around 5%, but the total deal value fell by nearly 35%[1]. In Europe, the trend mirrors this decline, with both the value and number of life sciences deals dropping post-2021[2].

European Investment Landscape in Life Sciences – Are We Too Pessimistic?

While some of these shifts in M&A activity can be seen as a natural correction following COVID-19, the reality is that many outstanding European companies seeking initial or follow-up funding are feeling disheartened about their fundraising prospects this year. But do M&A trends accurately mirror developments in the venture capital (VC) space, and is the VC investment climate in Europe really as grim as it looks?

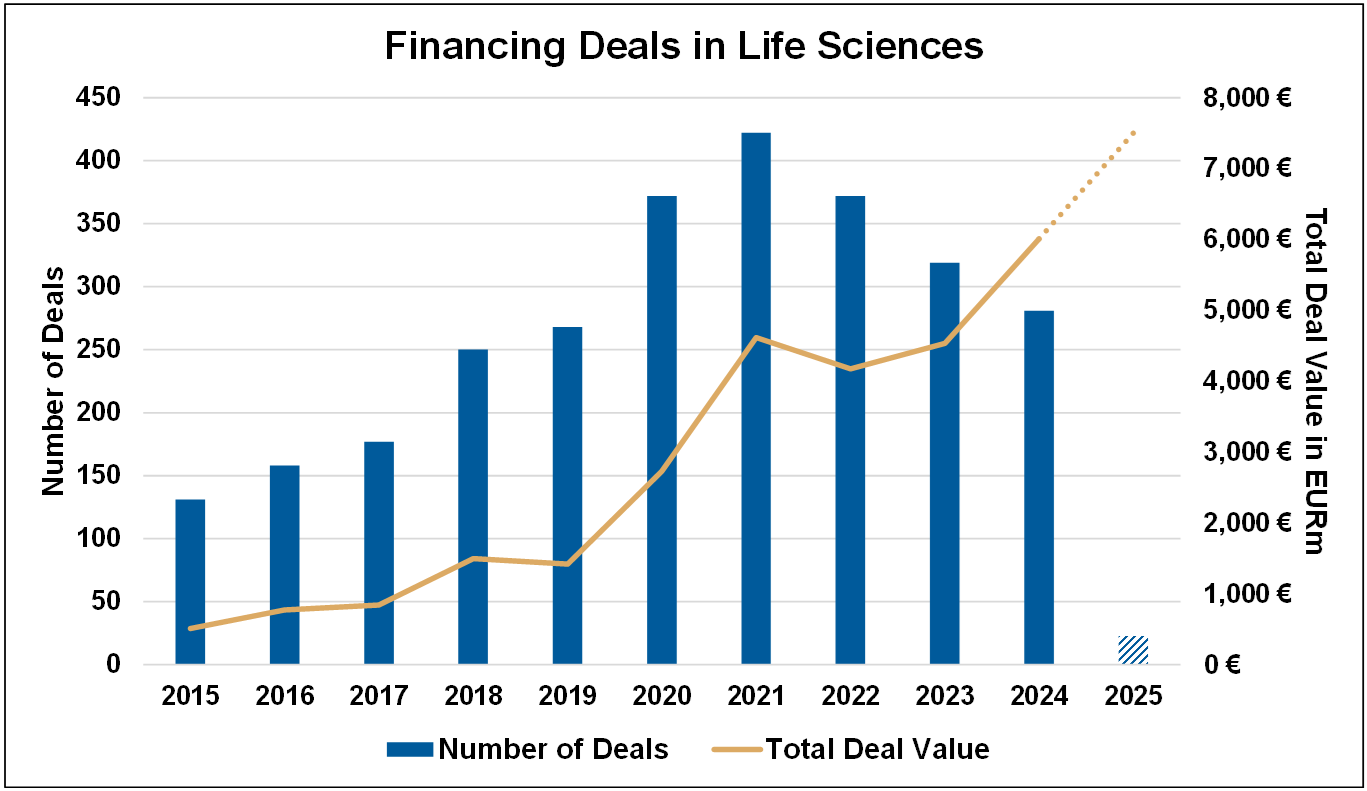

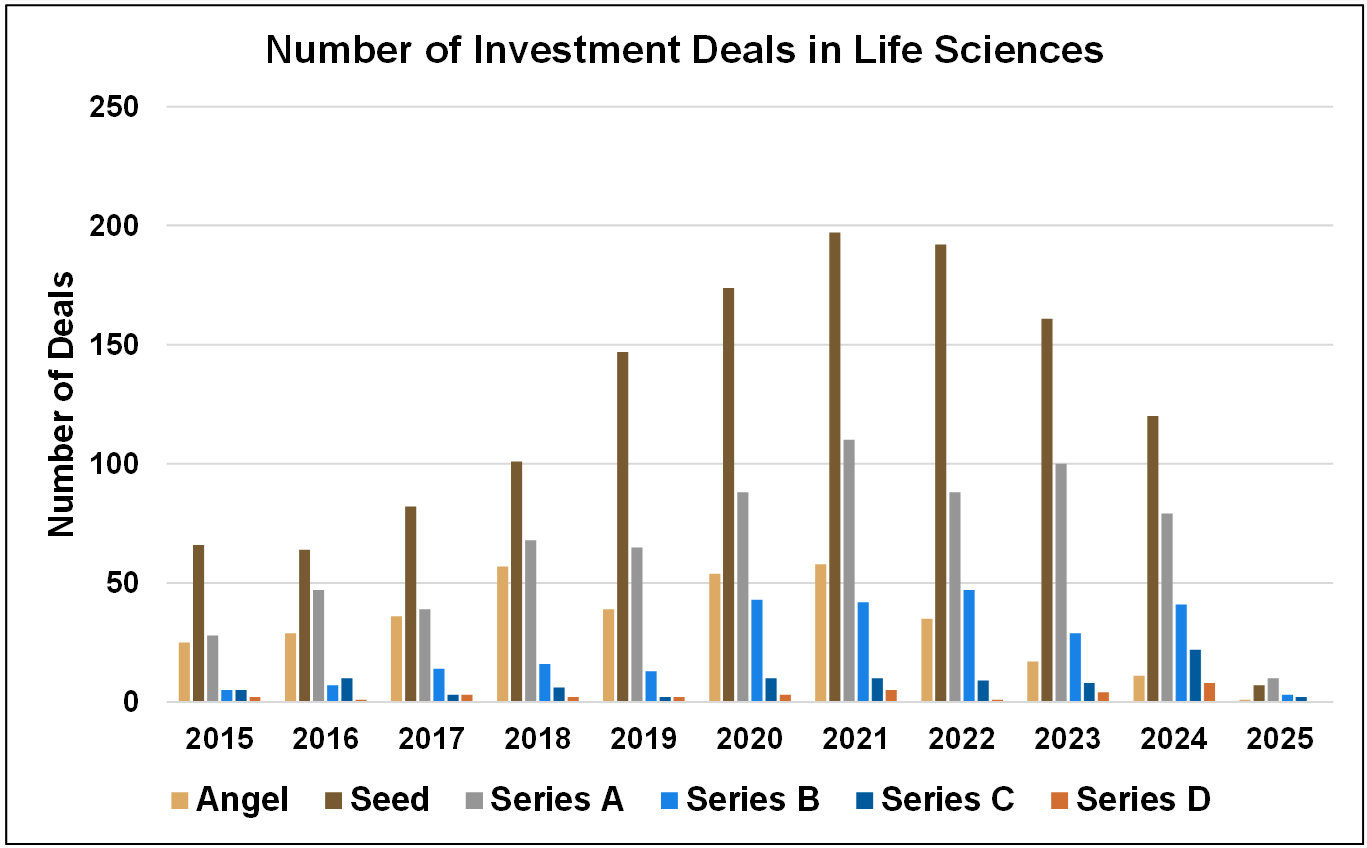

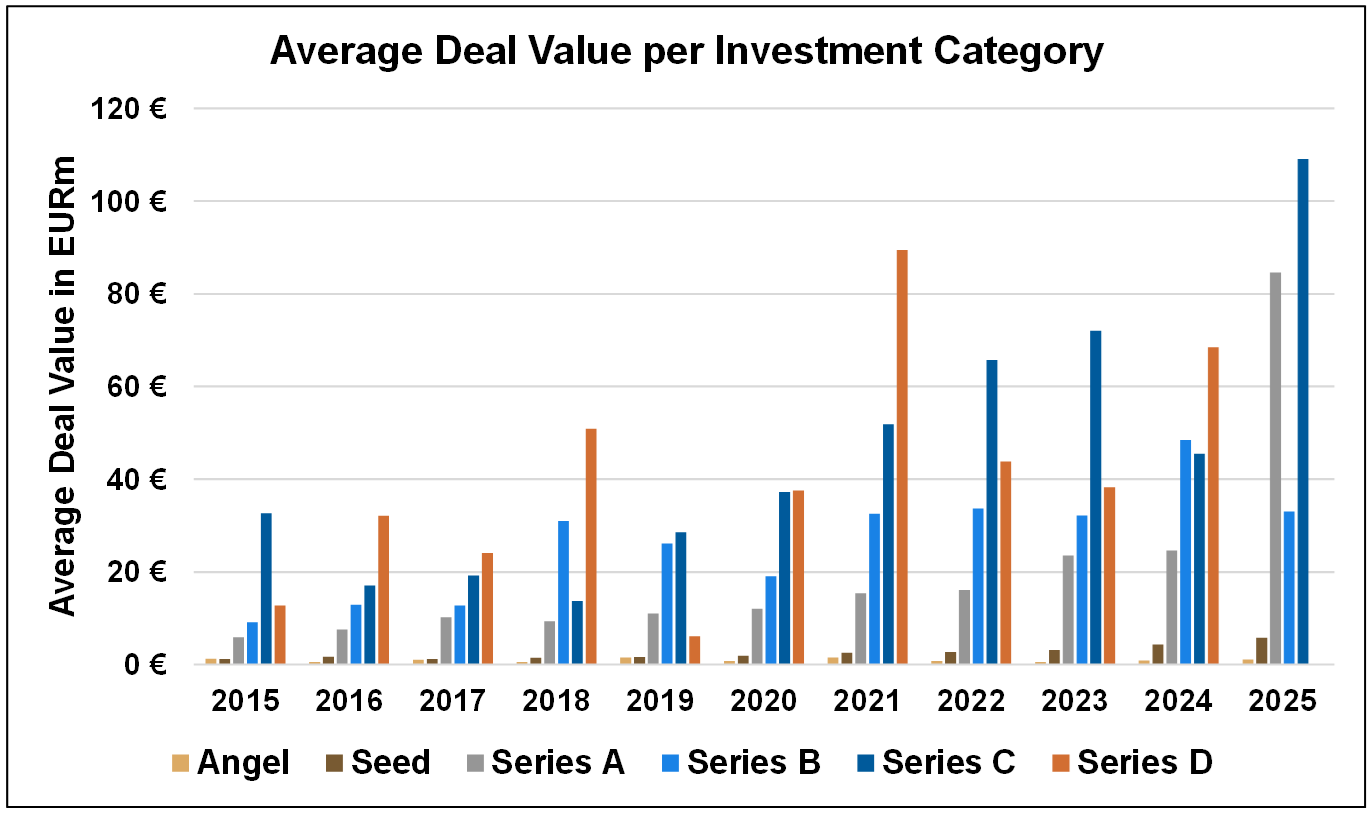

The data we analysed[3] confirms the trend of fewer deals year-over-year, yet we have observed an increase in total deal value: from EUR 4.2 billion in 2022 to EUR 4.5 billion in 2023 (similar to the COVID-19 year of 2021), and up to EUR 6.0 billion in 2024 (Figure 1). When examining the different VC stages, the number of Angel and Seed investments has notably decreased, while Series A to Series D investments have remained relatively stable (Figure 2).

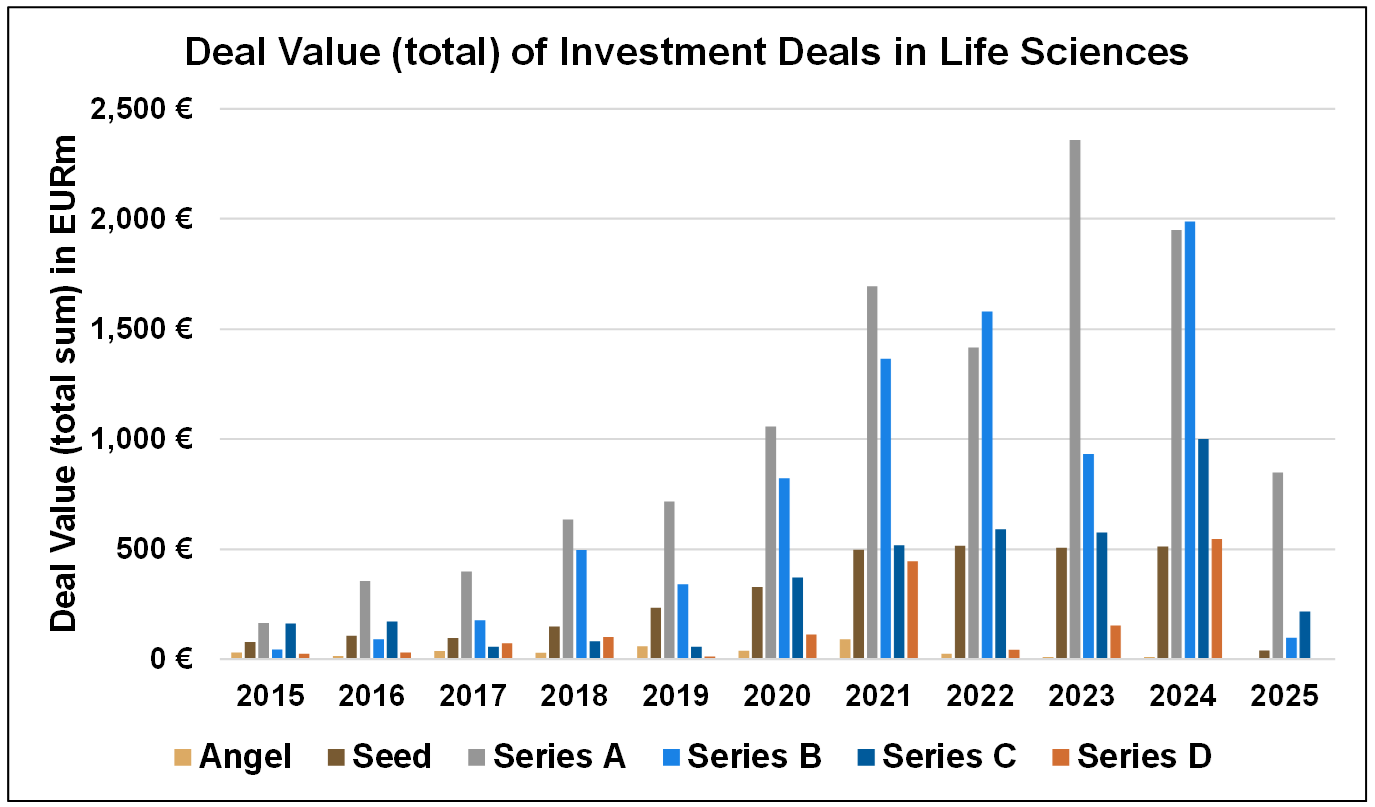

The total deal value for Seed to Series D investments remains strong, with only Angel investments experiencing a significant drop from EUR 90 million in 2021 to EUR 10 million in 2024 (Figure 3).

Figure 3: Overview of total deal value of investment deals in each Venture Capital (VC) investment category (Angel to Series D) between 2015 and early 2025. The total deal value for Seed to Series D investments remains strong; only Angel investments experience a drop in total deal value. Please note that for the year 2025 only 23 deals are included. EURm = Euro million. Copyright: Bioscience Valuation BSV GmbH

The overall deal value shows considerable fluctuations, which is expected given the variability in individual deal sizes – for instance, Verdiva Bio secured a $410 million Series A investment[4], nearly half of the total Series A deal value in 2025 so far.

While the number of deals has indeed decreased – with approximately 280 Angel to Series D deals in 2024, roughly on par with pre-COVID-19 levels (268 deals in 2019) – the overall deal value continues to rise (with only a minor decline post-COVID-19) which is encouraging. It seems that investors are willing to commit larger sums to companies they believe in. These trends, though with some fluctuations, can be seen across all investment stages (Figure 4).

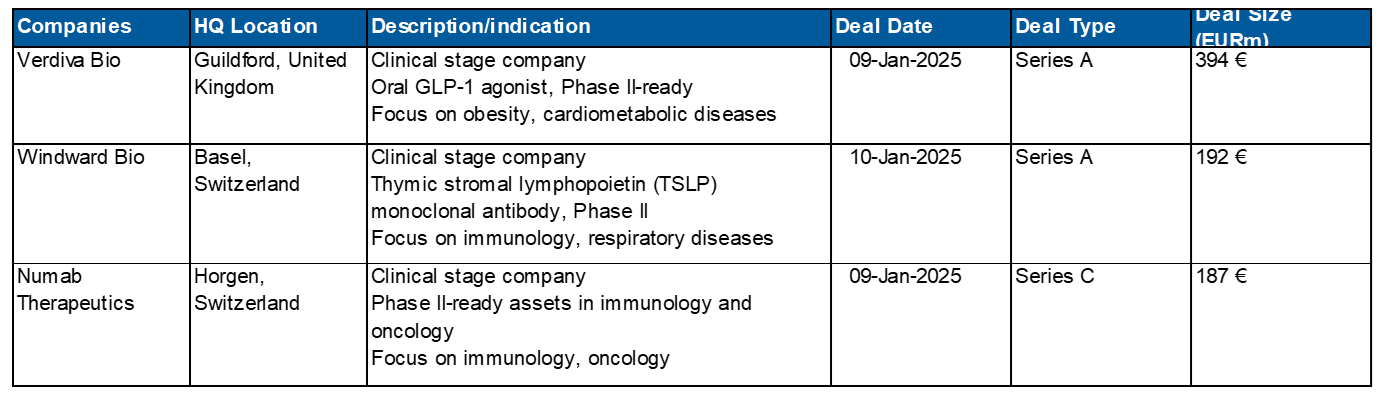

Oncology remains a key area of focus for investors, with nearly 30% of investments between 2015 and today directed towards companies in this field. Other areas of interest include cardiometabolic diseases and immunology. In fact, the top three investments in 2025 so far have been in obesity, immunology/respiratory, and immunology/oncology companies (Table 1). Artificial intelligence is also drawing attention, with more than 10% of investment deals directed towards this area in the past 10 years.

The overall trend is positive

Are we being overly pessimistic about venture capital investments in European life sciences companies? We believe we are. While investors are becoming more selective, leading to fewer investments, some might argue that this is a necessary and positive shift following COVID-19, when some companies received funding that perhaps was not fully justified. On the flip side, critics might say that deserving companies today are being overlooked. Regardless of one’s perspective on the number of investments, it’s clear that deal values are trending upward. This is well overdue, as Europe excels in scientific research, producing twice as many scientific publications compared to the US.[5] However, as Jack O’Meara pointed out in his 2022 article, „life sciences funding in Europe still remains just a fraction of that received by US startups, with its share of total venture capital dollars decreasing over the past three years: 24%, 22%, and 21%.“[5] It’s time to roll up our sleeves and drive European biotech to where it belongs: the top!

References:

[1] Cooley’s 2024 Life Sciences M&A Year in review: M&A slims down in 2024, but will appetites grow in 2025? (2025, January 24). Cooley M&A. https://cooleyma.com/2025/01/22/cooleys-2024-life-sciences-ma-year-in-review-ma-slims-down-in-2024-but-will-appetites-grow-in-2025/

[2] KPMG Switzerland, Deal Advisory, Life Sciences Strategy. (2024). European Life Sciences deals overview 2023 & 2024 outlook. https://assets.kpmg.com/content/dam/kpmgsites/ch/pdf/kpmg-ch-european-life-sciences-deals-overview-2023-2024.pdf.coredownload.inline.pdf

[3] PitchBook online database (retrieved February 2025). Search terms included: Verticals: Life Sciences; Deal Date: 01-Jan-2025 to 10-Feb-2025; Deal Size: min. EUR 0.05m; Deal Status: completed; Deal Types: All VC Stages OR Angel, Seed, Series A, Series B, Series C, Series D; Ownership Status: privately held; Location: Europe (Head quarter of respective company located in Europe). Please note that only deals have been included which have been categorized as Angel investment, Seed investment, Series A, Series B, Series C or Series D. Other deal categories (e.g., Series E) or deals not classified, have been removed from this list.

[4] Verdiva Bio. (2025, January 9). Verdiva bio. https://verdivabio.com/#top

[5] O’Meara, J. (2025, February 13). A new era in European life sciences investment. PharmExec. https://www.pharmexec.com/view/a-new-era-in-european-life-sciences-investment

[6] Please note that only deals which have been categorized as Angel investment, Seed investment, Series A, Series B, Series C or Series D are included. Other deal categories (e.g., Series E) or deals not classified, have been removed from this list.