Bildnachweis: Andrii Zastrozhnov – stock.adobe.com, Bioscience Valuation BSV GmbH.

Since the 1990s, there has been a shift in focus within pharmaceutical R&D. It resulted in placing greater emphasis on areas such as cancer, immunological diseases, and previously neglected therapy areas, such as orphan indications with high medical need. This development led to changes of product launches in the past 30 years and an average decline of sales per product. Does this indicate that the industry needs to change?

Cardiovascular diseases were a major focus in the 1990s, while rare diseases or drugs targeting small patient groups were less popular. In the meantime, progress in molecular biology enhanced our understanding of pathophysiology and new technologies helped to translate this understanding into innovative products. We have investigated whether these perceived trends are visible in the pattern and number of new product launches over the past 30 years. In addition, we have put this into perspective to average expected sales per drug in late-stage development. This article primarily focuses on the USA due to the availability of data in this territory.

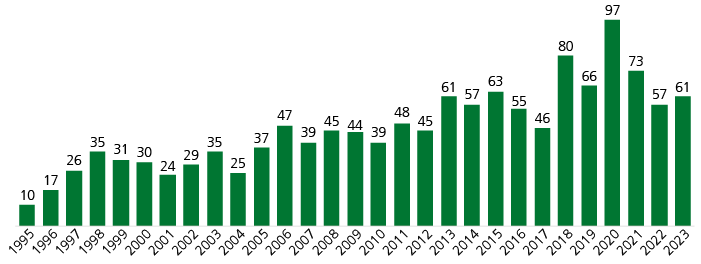

Number of new product launches increases

We observe a clear trend towards an increase in R&D output, as indicated in Fig. 1. The number of new product launches in the observed time interval grew at a CAGR of 6.7% while yearly volatility was high. The overall number of drugs marketed in the USA increased steadily from around 500 in 1995 up to around 2,800 by 2024 (Pharmaprojects, retrieved February 2024).

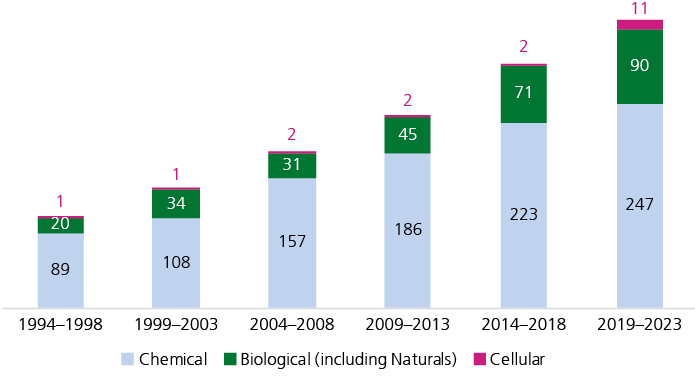

A gradual shift in product categories

A gradual increase in the fraction of biological products can be observed (Fig. 2). Today, about 22% of newly launched products in the USA are classified as biologics (this category also includes natural products), and 19 cell therapies have reached the market since 2019 (Pharmaprojects, retrieved February 2024). This highlights how progress in molecular biology and biotechnology is translated into innovative therapies.

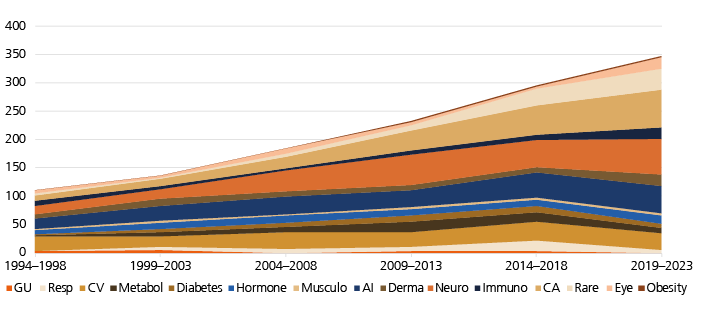

Relative number of launches per disease group changes

New drugs launched between 1994 and 2023 were also categorized according to 15 disease groups, as shown in Fig. 3. Drug launches are grouped in five-year intervals. We have calculated the percentage of drugs of a given disease group relative to all drugs launched, leading to the following observations:

- Cardiovascular (‘CV’): there is a significant decline in the relative number of drugs launched compared to other indications, but the absolute number of launched drugs remained stable in the observation period.

- Products for the therapy of cancer (‘CA’) showed the strongest relative growth, increasing from 8% to 19% of new launches.

- Launches of products for the therapy of rare diseases (‘Rare’) also increased strongly, from 5% to 11%. However, from 1999 to 2013, there was a decline to 1%, 3%, and 4%, respectively, which recovered during the following ten years. Please note that this category not only includes rare genetic diseases but also small subgroups of larger indications that would fall into the category ‘orphan diseases’ by the number of affected patients.

- Neurological diseases (‘Neuro’) saw a moderate and volatile increase in new drug launches in the observation period. This category includes new drugs for acute and chronic neurological indications, psychiatric diseases and pain.

- In the past decade, complaints were raised that the industry may neglect the need for innovative anti-infectives (‘AI’), in particular antibiotics (because of increasing antibacterial resistance). The current analysis shows a trend towards a decline in the percentage of launches of AI relative to all drugs. However, there was an increase in absolute numbers of anti-infectives entering the market.

- Drugs of all remaining categories remained stable over time regarding their relative fraction compared to the overall number of launches, with little movement up or down.

Average sales per drug appear to decline

The question arises whether the growing number of new drug launches and marketed drugs is accompanied by an increase of average expected sales per drug. Analyses suggest that the opposite might be true. Deloitte has been investigating the performance of the biopharmaceutical industry since 2010, using information from the top 20 companies (‘Measuring the return from pharmaceutical innovation 2022’, January 2023). Their report indicates that projected worldwide average peak sales for each new biopharmaceutical asset in late development declined at a CAGR of -2.7% between 2013 and 2022. Average forecasted peak sales per asset turned out to be at USD 389 million in 2022, compared to USD 500 million in 2021. They also found that the average expected ROI fell to 1.2% in 2022, the lowest level since 2010. Furthermore, they observe a trend towards increasing average clinical development time (including approval). The authors note that COVID-19 products may have influenced the analytics but do not explain the decline of expected average sales.

Conclusion

In conclusion, three key messages can be drawn from this analysis:

- The number of drug launches has been increasing, the majority of new products are still small molecules.

- Cancer, rare diseases, and, to a lesser extent, neurology are the categories with the strongest growth relative to other indications, confirming the shift in R&D focus.

- Trends in the last decade suggest that, on average, expected sales for innovative drugs are decreasing as well as ROI.

The shift in R&D focus may indicate that some diseases already enjoy a high therapy standard making it difficult to develop innovative pharmaceuticals offering sufficient incremental clinical benefit to ensure commercial success. Taking advantage of scientific progress in molecular biology, as yet underserved cancer indications and patient groups with specific, highly expressed molecular markers can now be targeted. However, this leads to a stratification resulting in smaller patient target groups, which may explain declining expected sales from innovation. The same applies to rare diseases, where in some cases increasing competition adds to the problem.

If this trend consolidates in the future, the industry will have to adapt its business model. Deloitte proposes measures to enhance efficiency of clinical development to increase ROI. We can expect this to have positive effects in the near term. In addition, there are still therapy areas with large patient numbers, such as chronic neurological diseases, that await effective treatments. However, we expect that the industry may have to adopt models of integrated care in the long run where innovative drugs are developed in conjunction with additional therapeutic approaches or healthcare services to further improve outcomes. Type 2 diabetes mellitus may be an example to consider.

Dieser Artikel ist in der Plattform Life-Sciences-Ausgabe 1-2024 erschienen.