Bildnachweis: The Little Hut – stock.adobe.com, Viopas Venture Consulting | July 2024, Viopas Venture Consulting.

European medtech and biotech companies might find engaging in a reverse merger (RM) with a US-based Nasdaq-listed company to be an appealing alternative to a straight IPO. Undoubtedly, access to the liquid US capital market and a larger investor base can facilitate funding of a growing business and frequently is seen as attractive exit option for investors. However, CEOs and board members are faced with the challenge to select the right procedure: standard RM or RM under the ‘sign-and-close’ mechanism – which one to choose?

Access to a liquid capital market is vital for the healthcare industry to thrive. Tapping into the US capital market is, in principle, a preferred scenario for many European-based medtech and biotech companies. However, for a multitude of reasons, a straight IPO on the Nasdaq is not feasible for the vast majority of European companies. A reverse merger (RM), whereby the private European company (PrivCo) merges into a US-domiciled Nasdaq-listed company (PubCo), offers a viable option for European companies to access the public US capital market. In a typical RM, the PrivCo acquires a majority stake in the PubCo, and after the merger, the PrivCo’s shareholders and its nominated board members gain control of the combined entity (MergeCo).

Why should companies be interested in a reverse merger?

European companies may consider a RM if they have a successful, ideally commercial-stage pipeline that requires additional funding, investors seeking a liquidity event at attractive valuation and a management desiring to expand their business into the US market. Typical counterparts for an RM are listed US companies with a failed product or pipeline where investors lost confidence as the investment case evaporated and who are faced with a depressed share price. As shown in Figure 1, the RM offers a win-win situation for both types of such companies.

Why the ‘standard’ RM process may not work

A standard reverse merger (RM) process typically begins with the signing of a term sheet, upon which both parties agree to exclusivity. This is followed by further due diligence and the negotiation of a definitive merger (or share purchase) agreement, often including a fairness opinion for the PubCo. The transaction must be announced by the PubCo by the time the transaction documents are signed at the latest, potentially leading to market speculation and share price volatility. Subsequently, relevant documents and proxy statements must be filed with the US Securities and Exchange Commission (SEC). Once the SEC has cleared all required documents and PubCo shareholders have approved the transaction, the merger can close, usually several months after the signing.

The lengthy period between signing and closing has several drawbacks, including prolonged uncertainty for employees, customers, and business partners, potential negative reactions from shareholders or the market due to the extended process, and the lock-up of any concomitant cash injection during this period.

The ‘sign-and-close’ transaction as an alternative RM scenario

Combining the signing and closing events into a single event, resulting in the so called ‘sign-and-close’ transaction, can help to avoid many of the drawbacks of standard RMs. For example, by eliminating the requirement of PubCo shareholder approval prior to the closing provides for a higher transaction security at the pre-agreed valuations (as there is no speculation period between signing and closing) and limits exposure to PubCo share price fluctuations.

There are also some challenges that need to be considered in the context of a sign-and-close RM. The time for due diligence might be limited, and RM parties may overlook potential business risks. Furthermore, investors may disagree with the relative valuation between companies which would negatively impact post-merger share price development, and general regulatory issues or challenges may arise, as there is less time for regulatory scrutiny and thorough compliance assessment. However, these challenges can be managed with proper planning and preparation.

How to successfully execute a sign-and-close RM?

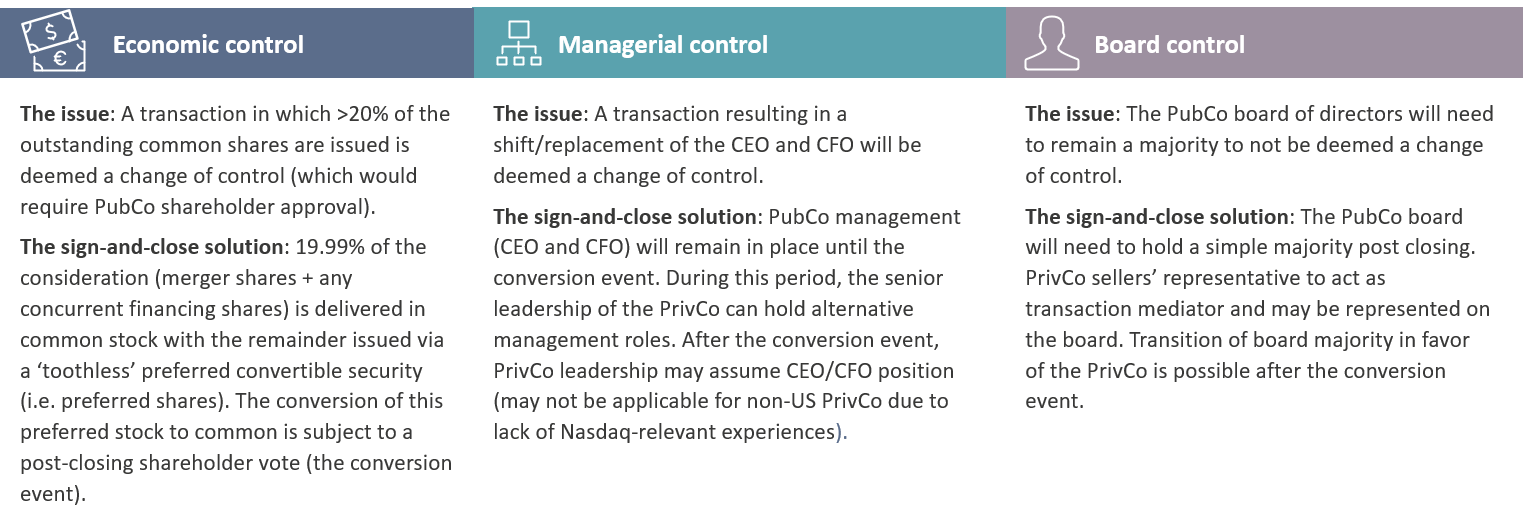

According to US regulations, a requirement for a sign-and-close reverse merger (RM) is to avoid a change of control at the PubCo at the time of the sign-and-close event. This change of control occurs at a later stage, referred to as the conversion event. Specifically, at the sign-and-close event, economic, managerial, and board controls must initially reside with the PubCo. How can this be resolved? Figure 2 describes the regulatory requirements/issues and solutions offered by the sign-and-close transaction.

After the sign-and-close event, the MergeCo becomes operational immediately, albeit under the control of PubCo management, board, and shareholders. The change of control occurs only after the combined financial statements of both companies have been prepared, audited, and submitted to the SEC for review, along with other documents (e.g., proxy statements). Upon completion of the SEC review and following a PubCo shareholder meeting to approve the issuance of additional common shares in exchange for the PrivCo shareholders’ preferred shares, the transaction is complete. This handover of the control of the MergeCo to the former PrivCo shareholders and the exchange of the remaining 80.1% of the purchase consideration constitutes the conversion event. The now-common shares owned by former PrivCo owners become freely tradable, although certain lock-up provisions may apply.

The sellers’ representative as transaction mediator

As stated, during the period between the sign-and-close event and the conversion event, which may last several months, PrivCo shareholders may wish to be represented at the MergeCo by a dedicated individual to ensure that the contractually agreed RM transaction is followed. To fulfil this role, a sellers’ representative may be elected and become a party to the share purchase agreement underlying the sign-and-close RM, which then also shall define the sellers’ representative’s tasks. One of these tasks is issuing regular updates to the sellers on business-critical matters and ensuring that PrivCo shareholders receive information, such as tax filing obligations. It is important, however, that the sellers’ representative avoids disclosing material non-public information to sellers/PrivCo shareholders. Additionally, the sellers’ representative, in close consultation with the sellers/PrivCo shareholders, shall propose candidates for the board of directors to be elected at the time of the conversion event.

Topics for board room discussions

A reverse merger (RM), especially when executed as a sign-and-close transaction, can be an attractive option for European medtech and biotech companies to gain access to the US capital market more rapidly and in most cases at lower cost than through a standard IPO process. While identifying a suitable match between companies on both sides of the Atlantic may pose challenges, the potential benefits for both companies and their shareholders make the effort worthwhile. The RM under the sign-and-close mechanism provides European companies with immediate operational capabilities, including access to the US capital market and a listing on the most liquid capital market for the medtech and biotech industry.

Disclosures: this article is based on material by Ladenburg Thalmann and publicly available SEC filing documents.

Autor/Autorin

Dr Thomas Meier

Dr Thomas Meieris managing partner at Viopas Venture Consulting. With offices in Basel, Zurich, Munich and Vienna, the firm provides strategic, operational, business and finance advice to life sciences companies and investors. Dr Meier has an academic background in neurosciences and an extensive track record as entrepreneur, CEO and board member. He serves as sellers’ representative for a reverse merger leading to Onconetix, Inc.