The 35% downturn of the NASDAQ Biotechnology Index between September 2021 and June 2022 sparked discussions as to whether there may be biotech investment strategies that shield against market turbulences in the biotech sector. We propose that investing in private early-stage biotech assets or companies may be a successful strategy to partially mitigate public markets’ systematic risk. In fact, we suggest that investing in early-stage biotech companies is superior to strategies that invest primarily in late-stage biotech companies, public or private.

In two previous publications in this journal, we showed that early-stage value gains are higher than predicted by the resolution of development risk[1], whereas late-stage (clinical) value gains are often less than expected[2]. Therefore, we hypothesize that venture funds investing in early-stage assets should provide higher returns compared to other funds. We argue that funds with a focus on early-stage biotech companies indeed provide higher returns than their peers.

Rates of return for venture funds engaged in biotechnology compared to other industries

We analysed returns for three different investment strategies over the past 20 years[3]:

- biotech venture funds that focus on early-stage investments,

- biotech venture funds that focus on late-stage investments,

- venture funds that do not invest in biotech.

Table 1 shows the rates of return for the three investment strategies under consideration. Comparing the medians of all observations suggests an internal rate of return (IRR) of 24.90% for the early-stage biotech strategy, compared to just 9.72% for the late-stage biotech strategy and 18.63% for all other venture investment strategies excluding biotech. The variances percentiles. Again, the early-stage biotech investment strategy outperforms the alternative strategies as well for the 25th and 75th percentiles, suggesting significant differences in return distributions. Thus, our assessment provides further evidence for the superiority of an early-stage biotech investment strategy. Not only does this strategy outperform late-stage biotech investments; it is an even more valuable strategy when compared to venture investing in industries other than biotech.

A twenty-year perspective

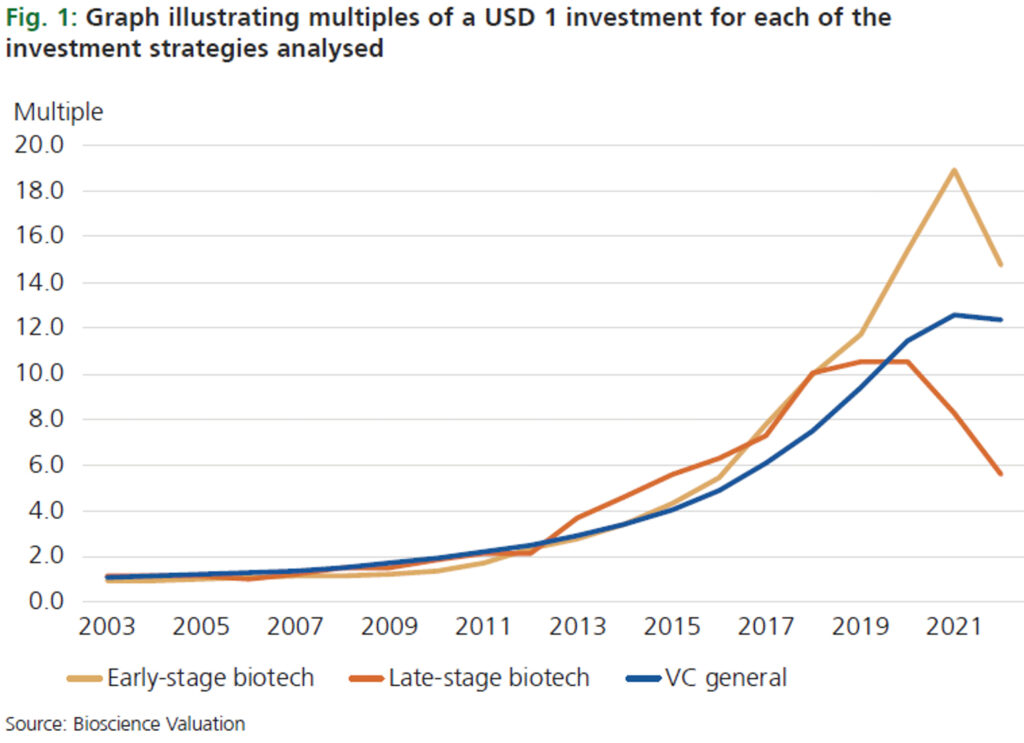

Consequently, a fund that invested USD 1 in early-stage biotech in 2003 should demonstrate a higher return figure today when compared to the alternative investment strategies.

By compounding annual fund returns, Fig. 1 shows that USD 1 invested in 2003 yields

- USD 14.73 for the early-stage biotech investment strategy,

- USD 5.62 for the late-stage biotech investment strategy, and

- USD 12.36 for alternative investment strategies that exclude biotech.

For the decade prior to 2012, the differences in return were rather small, providing multiples just above two for each investment strategy. Between 2013 and 2016, late-stage biotech investing produced higher returns; however, in 2017 and 2018, early-stage caught up, providing higher returns than the late-stage biotech strategy in 2019 and thereafter.

Although biotech experienced a sharp downturn between 2021 and 2022 (that began earlier for late-stage investments), investors in early-stage companies received decent multiples for their investments. Without the 2022 decline, this multiple would have been even higher as indicated by the 2021 figure (multiple early-stage = 18.90).

Maximizing returns

In the past, venture-capital returns have often exceeded those of other asset classes such as real estate, real assets or investments in an S&P 500 portfolio. Here we show that early-stage biotech investments have the potential to outperform other investment strategies.

Interestingly, the share of early-stage venture capital deals has constantly declined over the past eight years, particularly in Europe[4]. In the USA, where capital is typically more readily available compared to Europe, the availability of early-stage capital has recently fallen, as indicated by the capital demand-supply ratio in the venture-capital marketplace[5]. This is surprising as our assessment demonstrates that investing in early-stage biotech may be particularly rewarding. As hypothesized earlierF[6], market inefficiencies may contribute to the outstanding returns achieved with early-stage investment strategies. We do hope, due to the favourable economics, that the current shortage of early-stage capital will soon be resolved, enabling young companies with promising development candidates to flourish.

[1] M. M. Greuel et al. (2022), Exploiting market inefficiencies in early-stage biotech investing, Plattform Life Sciences 3/2022, pp. 116–117.

[2] P. S. Steinbach et al. (2023), Comparing late-stage vs. early-stage investment strategies, Plattform Life Sciences 2/2023, pp. 26–27.

[3] Source: PitchBook, retrieved August 2023. Please note that PitchBook defines “early-stage” as seed, series A and series B funding if funds are obtained within five years after company foundation, and “late-stage” > =Series C, or if funding is obtained after more than five years past company foundation. In most cases, funds’ investment strategies are not “pure plays”, i.e., neither do funds invest only early-stage nor late-stage; often we find combinations of both strategies. Thus, the differentiation is based on the dominant strategy. We follow the categorization as suggested by PitchBook [4] PitchBook Q2 2023 European Venture Report.

[5] Q1 2023 PitchBook-NVCA Venture Monitor.

[6] M. M. Greuel et al. (2022), Exploiting market inefficiencies in early-stage biotech investing, Plattform Life Sciences 3/2022, pp. 116–117.